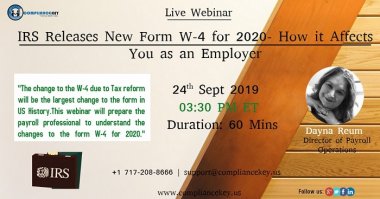

IRS Releases New Form W-4 for 2020

Discount Coupon : Use Promo Code NEW2COMPLIANCE and get (10% OFF) On New Signup

Overview

Dec of 2017 The Tax Cuts and Jobs Act was passed and it was one of the most significant tax changes in sometime. The change to the W-4 due to Tax reform will be the largest change to the form in US History. This webinar will prepare the payroll professional to understand the changes to the form W-4 for 2020 and to review the recently released draft on May 31 of 2019. Before these changes the Form W-4 was a critical form that all companies have to obtain from employees, that drives how federal income withholding tax is calculated.

Why should you attend this webinar?

The IRS released Publication 15-T on June 7, 2019 which gave instruction on how the new form will impact taxation. A review of publication 15-T and the steps to completed federal tax withholding calculations will be reviewed. All IRS specific laws around processing of the Form W-4 today and tomorrow discussed.

Who can Benefit:

Payroll Managers

Payroll Administrators

Payroll Garnishment Specialists

Contact Info :

Compliance Key

https://www.compliancekey.us

Email : support@compliancekey.us

Phone : +1 717-208-8666

Speaker and Presenter Information

Dayna Reum ,CPP, FPC is currently the Director of Payroll Operations at Ann & Robert H. Lurie Children's Hospital of Chicago . She has been heavily involved in the payroll field over 18+ years. Starting as a payroll clerk at a small Tucson company, She moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna's time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Relevant Government Agencies

County Government, Payroll Managers, Payroll Administrators

Event Type

Webcast

This event has no exhibitor/sponsor opportunities

When

Tue, Sep 24, 2019, 3:30pm - 4:30pm

ET

Website

Click here to visit event website

Organizer

Compliance Key